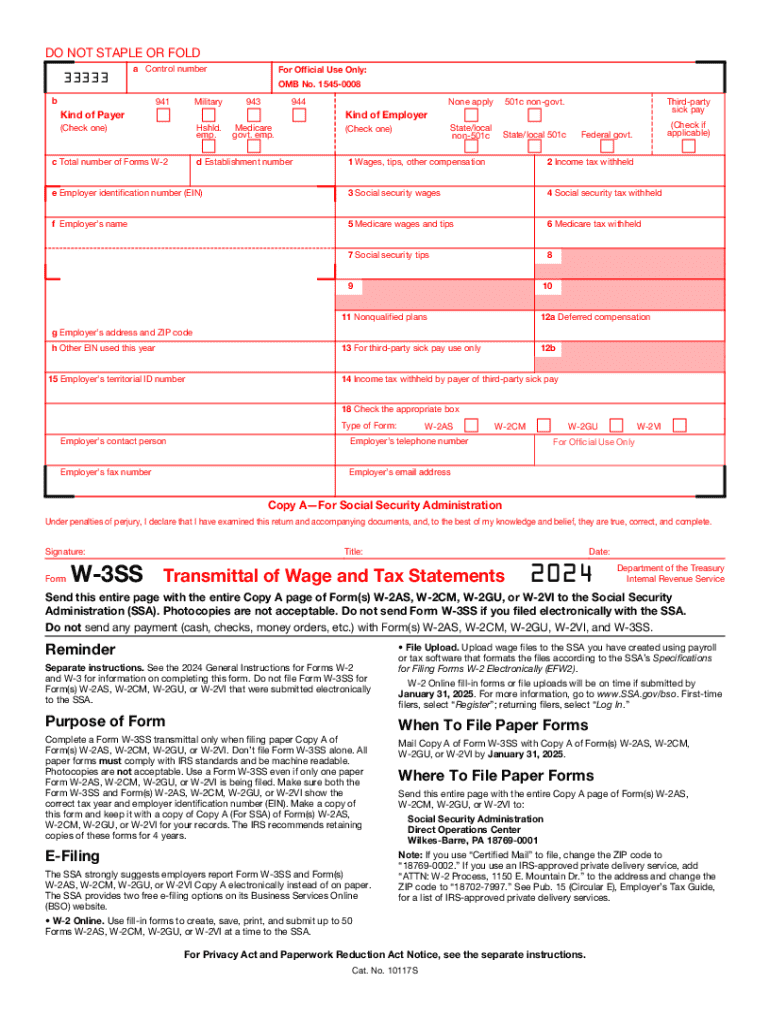

IRS W-3SS 2024-2025 free printable template

Instructions and Help about IRS W-3SS

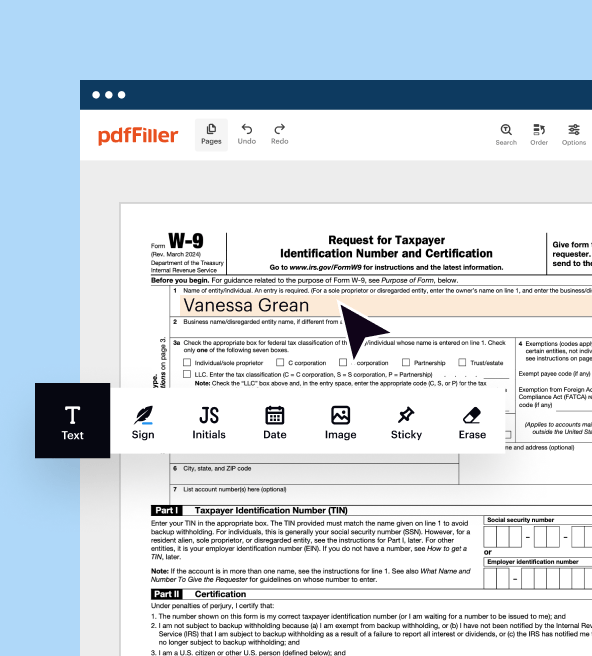

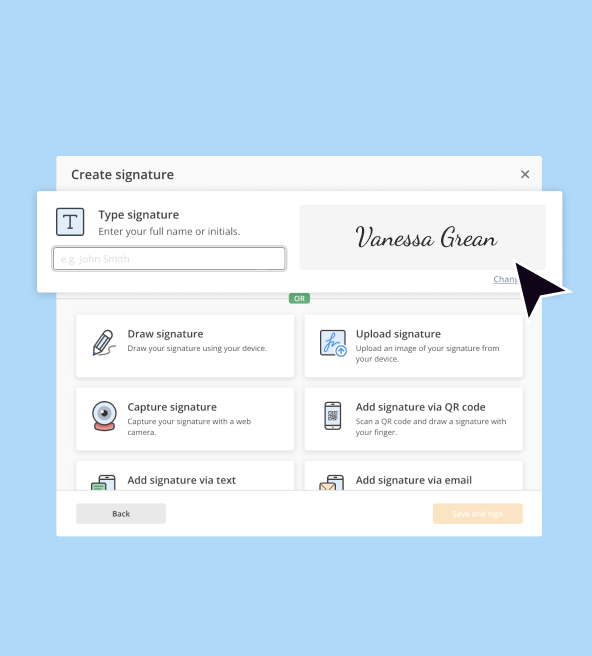

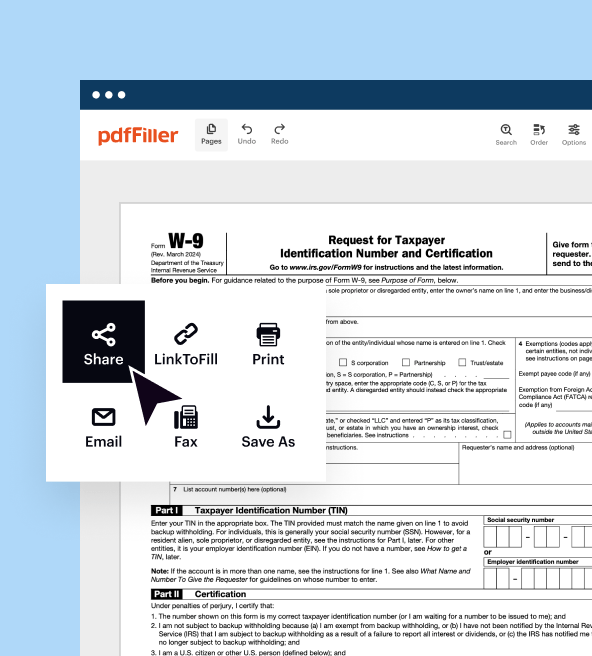

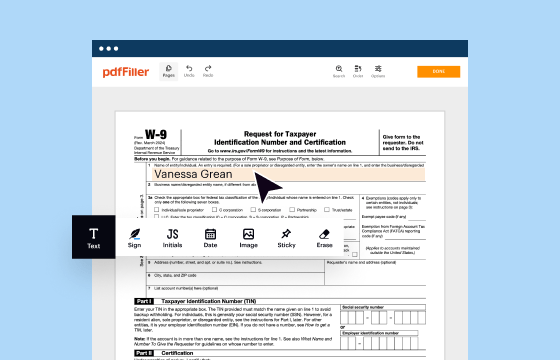

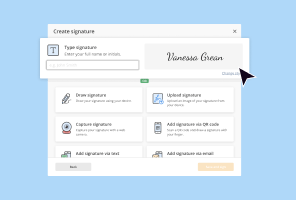

How to edit IRS W-3SS

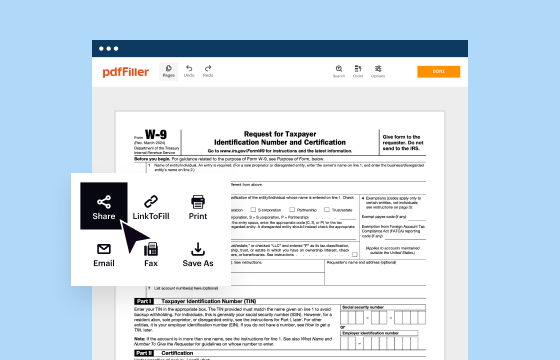

How to fill out IRS W-3SS

Latest updates to IRS W-3SS

All You Need to Know About IRS W-3SS

What is IRS W-3SS?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-3SS

What should I do if I realize I've made a mistake after submitting the IRS W-3SS?

If you discover an error after filing the IRS W-3SS, you can submit a corrected version of the form. It's important to clearly mark it as 'Corrected' at the top of the form before sending it in. Make sure to also keep a copy of the corrected form and any correspondence for your records.

How can I check the status of my IRS W-3SS submission?

To verify the receipt and processing of your IRS W-3SS, you can contact the IRS directly or use the e-file tracking functionality provided by your filing software. It’s crucial to have your submission details handy to facilitate this process.

What common errors should I be aware of when filing the IRS W-3SS?

Common errors while filing the IRS W-3SS include incorrect taxpayer identification numbers and mismatching names. Ensure all information matches the IRS records to avoid rejections or delays. Double-checking entries before submission can minimize these issues.

Are there any specific requirements for filing the IRS W-3SS electronically?

When e-filing the IRS W-3SS, ensure that the software you use is approved by the IRS. Check compatibility with your operating system and ensure your internet connection is stable. Additionally, follow the guidelines provided by the e-filing service for smooth submission.

See what our users say